We’ve come to that part of the year again, today marks the return of the Budget statement. The event where the UK Chancellor explains how the government plans to earn, borrow and spend funds in the upcoming tax years.

Before the Budget is announced, I want to concentrate on explaining a new financial product available to millennials, the Lifetime ISA.

What is the Lifetime ISA?

Some of your may be accustomed to ISAs, be it the normal cash ISA, stocks and shares ISA or Help to Buy ISA, but now we have something different.

The Lifetime ISA heralds a new age of longterm saving and investing, with the government taking on the mantle as the salesman for saving. For every £4 you save, the government will add £1 (worth up to £1,000 a year) paid at the end of tax year, up to the age of 50. Up to £4,000 a year is eligible for the 25% bonus. In the first year it will be paid annually, but from the 2018/19 tax year onwards the bonus is paid every month

The Lifetime ISA will be available from 6 April 2017 for adults aged 18-39 (if you turn 40 on or before 6 April 2017 you won’t be eligible). If you open a LISA you can combine it with the other ISA types as long as your overall contributions are within the annual ISA limit. This limit will increase to £20,000 from April 2017.

Sounds good right, but what are the real positives and drawbacks from the scheme?

Benefits

– Money grows tax-free and withdrawals are tax-free (withdrawls are tax-free after the age of 60)

– Parents and grandparents can also pay into a LISA opened by their child or grandchild

– LISA savings and bonuses can go towards a deposit on your first property ((valued up to £450,000 in London and £250,000 elsewhere) or to fund retirement

– LISAs are limited per person, not per home, so if you’re part of a couple you can both from the government bonuses before buying a property together.

Disadvantages

– Early withdrawals incur penalty fees up to 25% of the amount withdrawn

– It is not yet clear what exceptions will be in place for penalty free withdrawals e.g. at present only withdrawals for terminal illnesses are penalty free

– It is not yet clear if you can borrow funds against your LISA without incurring a charge

Lifetime ISA providers

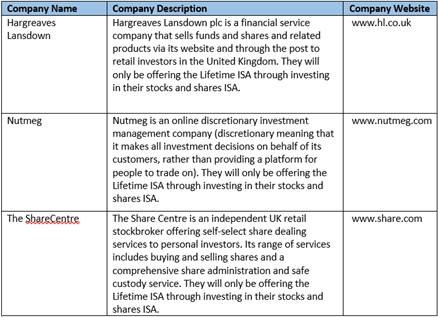

Now if you’re interested, where will you possibly be able to go to get involved? Unfortunately, only a few firms are offering Lifetime ISAs from the 6 April 2017 start date, most are awaiting await further government guidance, the companies offering the ISAs from the start date are below:

So many options, so little time?

The millennial generation is generally quite impatient, familiar with instant gratification whilst growing up in the social media age. Expecting that same generation to be patient enough to wait for available income and funds for 20 to 42 years might be a stretch.

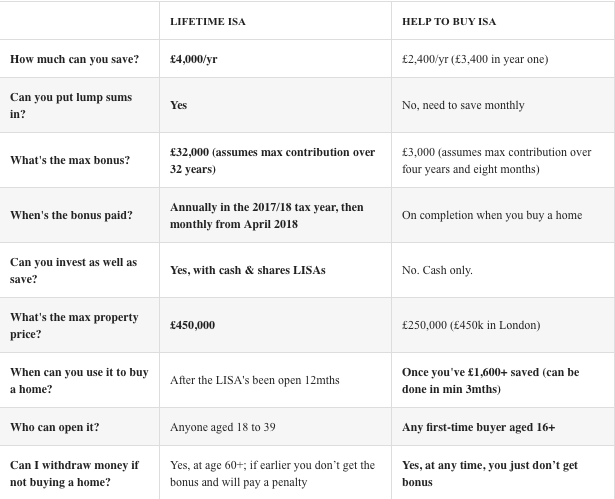

LISA, HTB or both?

If you have a Help to Buy ISA, you can transfer those savings into your Lifetime ISA or you can continue to save into both – but you’ll only be able to use the government bonus from one to buy your first home. The greatest benefit from a LISA might be from using the LISA funds to purchase your first home, and withdrawing funds held in a Help to Buy ISA to put towards personal expenditure..

This is worthwhile because the LISA government bonus is higher than the HTB ISA bonus, you might think why is it beneficial contributing to a HTB ISA if I have a LISA then? Many HTB ISA from providers offer interest from anywhere between 2% – 4%, see here.

This means you can earn relatively strong returns on your savings that can be used for personal use, whether that be for a first home or alternative expenditure. Remember any interest earned during the span of your HTB investment cycle can be kept, regardless if the HTB funds are used towards your first home purchase or not. A reminder that the LISA must have been opened for at least 12 months before you can withdraw funds from it to buy your first home.

Hopefully, this review has helped provide guidance towards how and why the Lifetime ISA may be beneficial. The LISA seems like a great longterm tool to use to save and invest tax efficiently if you have the required investment discipline not to withdraw. Otherwise it is still a good alternative to the Help to Buy ISA for those looking to buy their first home beyond the 2018 time horizon.

More information on Lifetime ISAs can be found directly from the UK government here.

Please also be assured the above information provided does not in any way constitute as an investment recommendation. We advise anyone interested in the above products and services to read through their terms and conditions thoroughly and contact a financial advisor before making an investment decision regarding the products and services.