I’m back again with another personal finance piece, the low-key period between Christmas and New Year can have your mind wonder as to what do with your money for the upcoming year.

I’m a millennial so I have always been interested in new innovative personal finance platforms so I’ve decided to write a brief review of some options available with supporting advantages and disadvantages.

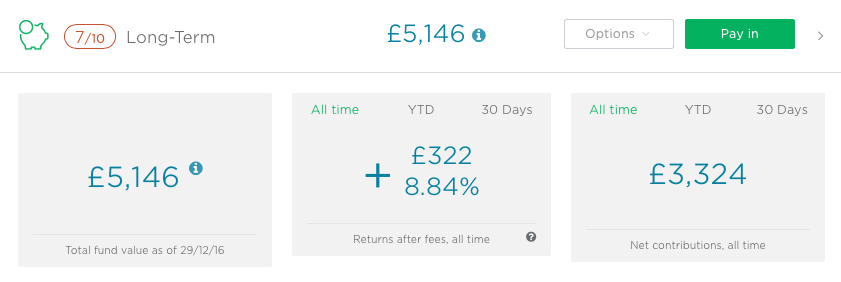

Nutmeg

The first platform review is Nutmeg, I won’t delve too deeply as I have written about this platform before here.

Nutmeg is an online investment management platform aimed at retail investors, particularly helpful for the millennial generation familiar with customer friendly interfaces.

Nutmeg allows you to contribute monthly amounts into a portfolio, you can choose a risk rating between 1 – 10 to decide how high you want your return to be, your risk rating correlated with your expected return.

You can set up a fund with the firm online and they take care of the analysing, researching and executive investment decisions. Which leaves you with time to enjoy what you want.

Advantages

• Business daily updates on your portfolio

• Customer friendly platform interface

• Returns are tax-free, i.e. the product is covered by an Individual Savings Account (ISA)

Disadvantages

• Fee charges for early withdrawals

• Minimum investment requirements of £1000 with £50 monthly contributions

More information on Nutmeg can be found here.

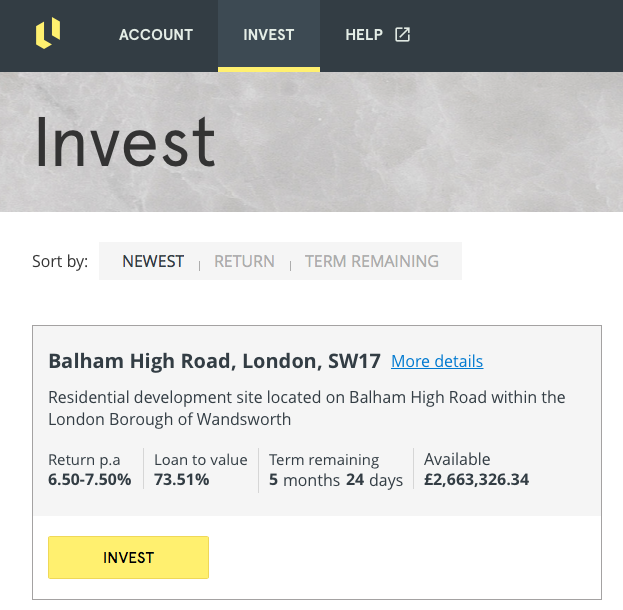

LendInvest

LendInvest is entirely built on property lending; the platform allows you to invest in loans secured against property, the interest rates on offer are upwards between 5%. The terms typically last between 5 to 12 months.

LendInvest is an online loan platform, good for financially competent people familiar with customer friendly interfaces, offering good returns of interest relative to the level of risk being undertaken.

The platform allows you to choose from a variety of loans that are secured against property collateral. Companies financing property development within the UK require the loans.

Advantages

• Business daily updates on your portfolio

• Customer friendly platform interface

• Favourable interest rates supported by secured collateral

Disadvantages

• There is not an extensive amount of loans to invest in

• Interest is not tax-free, i.e. the product is not covered by an Individual Savings Account (ISA)

More information on LendInvest can be found here.

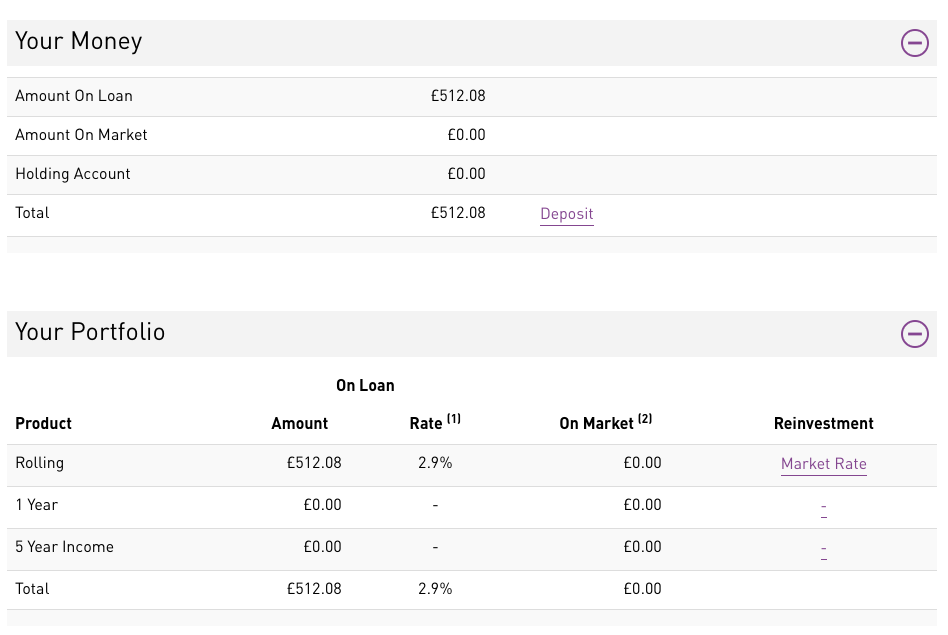

RateSetter

RateSetter is an online peer-to-peer lending platform; it allows investors to lend to small businesses and individuals on monthly, annual or five year terms. The interest rates on offer, typically between 2.9% – 5%, are relatively better than any interest rates being offered at your high street bank.

The platform allows you to set the interest rate you want to earn within certain parameters, you can therefore control the return you want.

Advantages

• Business daily updates on your portfolio

• Multiple options for lending; monthly rolling, annual and 5 year

• Favourable interest rates in comparison to High Street banks

Disadvantages

• Fee charges for debit card contributions below £1000

• Lending is not unsecured against collateral

• Interest is not tax-free, i.e. the product is not covered by an Individual Savings Account (ISA)

More information on RateSetter can be found here.

I hope the above helps you on your financial journey, stay up to date with @CapitalMoments on Twitter for any further updates about personal finance and future events.

Please also be assured the above information provided does not in any way constitute as an investment recommendation. We advise anyone interested in the above products and services to read through their terms and conditions thoroughly and contact a financial advisor before making an investment decision regarding the products and services.