Sorry for the deceitful title, this is not a post marketing the next best trading and investment course in your local shiny City plaza. It’s actually a blog examining the merits of distributed financial inclusion to limit against the rise of inequality; quite a mouthful of a sentence, I know.

Back to the topic, just this week, a study by the European Foundation for the Improvement of Living and Working Conditions (Eurofound) announced that the UK had the highest inequality level in the EU measure by the Gini coefficient as of 2011. Interesting right, or are you thinking, what’s a Gini co-efficient?

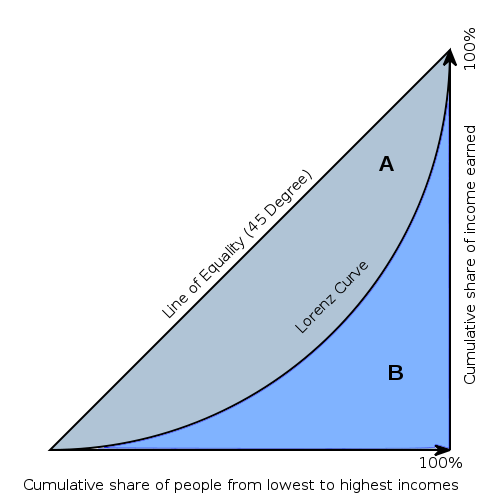

In short, the Gini co-efficient measures the cumulative distribution of income across different levels of earners and it’s exemplified by the below diagram; the Gini coefficient is equal to the area marked A divided by the sum of the areas marked A and B, that is, Gini = A/(A+B). The more inequal income distribution is then the larger the area of A is, which equates to a higher Gini-coefficient.

Now you understand what the co-efficient means, (if not, read more about the topic from this trusted source), you’ll understand the uproar when it was found the UK had a Gini coefficient of 0.404 compared to the EU average 0.346.

Solution

Now, although further studies show equality has improved somewhat since 2011, it is still nowhere near the levels of mes amis or los amigos across the Channel, so what can we do improve it – financial inclusion.

Ok, prepare yourself for a number of charts and diagrams because my proposed solution is the promotion of asset ownership. Many of the richest in society have seen their property, stocks and bonds boom in value compared to the anaemic growth of wages since the financial crisis, the below graphs illustrate this argument in full.

Throughout the majority of time between 2009-2014, despite unemployment falling from its peak of 8.4% in March 2011 to 5.5% today, wages have still continued to grow slower than inflation in the UK.

In opposite, the main benchmark stock indices in the UK, FTSE100 and FTSE 250, both grew 53.74% and 163.59% respectively from the end of 2008 until now.

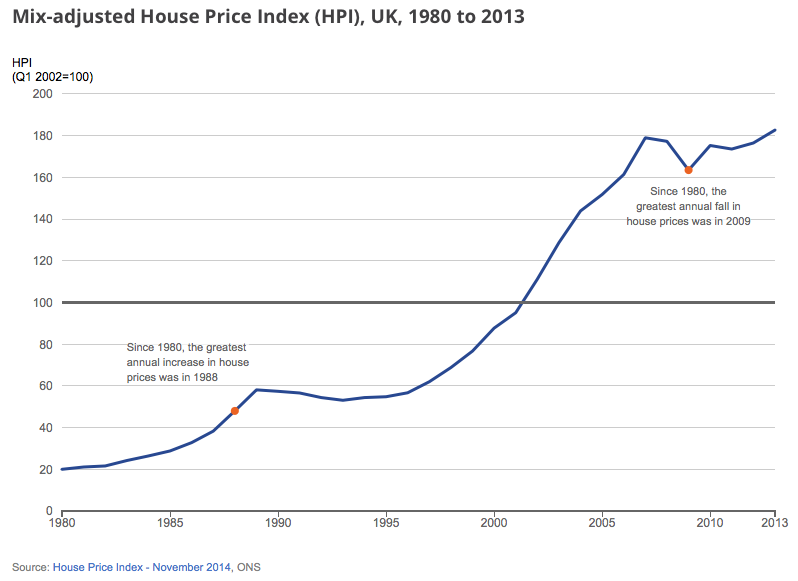

Better still for the private landlords and owner-occupiers who have seen the UK housing market recover from its recession slump, between 1980 to 2013, house prices multiplied by a incredible factor of 9.

All in this together?

In aggregate, the rise in asset values has seen asset owners benefit while those who rely solely on their wages for income have suffered. The solution calls for more people to delve into investment and asset ownership given current slow wage growth. Yes, there is a fundamental argument that those at the bottom should have their wages increased to a substantial living level but many middle class families have still suffered in the recovery despite reasonable base salaries.

More low and middle-income families should pool their resources in asset management and investment management funds to reap the benefits of asset price appreciation. I am not imploring for these families to plough their savings and miss out on their annual holiday to risk it all like the Wolf of Wall St. The UK public should take pragmatic saving decisions to put aside money in assets to ensure they can enjoy the financial ups in our economy.